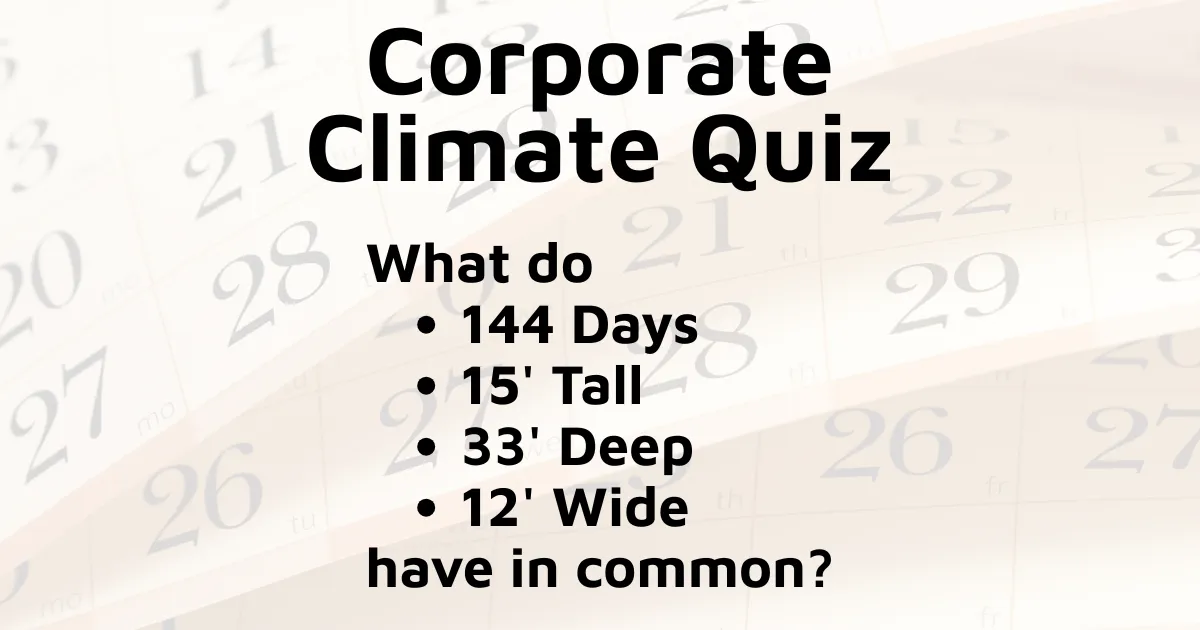

The “2025 Global Status of CCS Report” urges the industry to “stay the course,” but for Fortune 500 leaders, the current course is often too slow or too risky. In this executive editorial, CEO Beau Parmenter argues that the market has undervalued the “Time Value of Carbon.” By deploying Biochar Agricultural Direct Air Capture (DAC-P) via a proprietary crop with a 144-day lifecycle, corporations can secure verifiable, additional removal credits today, rather than speculating on decadal forestry projects or energy-intensive industrial infrastructure.

The Speed of Trust

In my conversations with Chief Sustainability Officers across the Fortune 500, a common theme emerges: Anxiety about time.

Corporations have made public, legally binding commitments to reach Net Zero by 2030 or 2050. Yet, the tools currently available to them are often out of sync with the urgency of their balance sheets. Industrial Direct Air Capture (DAC) is technologically distinctly impressive but capital-intensive and slow to deploy at the gigaton scale needed immediately. Traditional forestry projects, while emotionally resonant, operate on biological timelines that span decades—a tree planted today does not become a significant carbon sink until the 2040s.

The financial world understands the “Time Value of Money”—a dollar today is worth more than a dollar tomorrow. It is time we applied this same rigor to our climate strategy: The Time Value of Carbon.

A ton of CO₂ removed from the atmosphere this year is infinitely more valuable to the climate trajectory than a ton projected to be removed twenty years from now.

At Dynamic Carbon Credits, we have engineered a solution that solves for speed, scale, and permanence. We call it Agricultural Direct Air Capture & Biochar. It is not just a farming method; it is a biological technology platform designed for the enterprise.

Moving Beyond the "3-Inch Plant" Mentality

To truly impact Scope 1 emissions, we must stop treating agricultural carbon sequestration as a happy accident of food production. Relying on standard cover crops—what I call “3-inch plants”—to solve the climate crisis is like trying to power a data center with AA batteries. It lacks the necessary capacity.

We have taken a different path. We utilize a proprietary crop that is bred and deployed for a singular purpose: Carbon Sequestration.

This is not a passive landscape feature. It is a biological machine.

- Vertical Scale:

Standing 12 to 15 feet tall, our crop maximizes photosynthetic surface area, acting as a massive biological vacuum for atmospheric CO₂. - Subterranean Reach:

With a root system that drives 33 feet deep and spans 12 feet wide, we are accessing soil horizons that standard agriculture leaves untouched.

This massive root structure is critical. It allows us to inject carbon deep into the soil profile while simultaneously interacting with the microbiome to mitigate Methane and Nitrous Oxide via proprietary bacterial interactions and massive root exudates. When we talk about “High-Quality Carbon Removal,” this is the benchmark.

The 144-Day Cycle: Quarterly Results for the Planet

The “2025 Global Status of CCS Report” is titled Staying the Course. While I respect the sentiment, I believe we need to accelerate the vehicle.

The defining characteristic of our Agricultural Direct Air Capture and Biochar system is its velocity. Our crop completes its growth-to-credit registry lifecycle in just 144 days.

For a corporate buyer, this changes the game. You are no longer purchasing a “future promise” of carbon removal. You are purchasing a realized asset. In less than five months, we go from seed to verified sequestration. This allows sustainability leaders to align their carbon removal strategies with their quarterly reporting cycles, providing a level of agility and liquidity that traditional offsets simply cannot match.

The "True Removal" Premium

There is a race to the bottom in the voluntary carbon market, with buyers seeking the cheapest possible credits—often around $10-$20/ton for avoidance projects or renewable energy offsets.

But as the OECD and other watchdogs crack down on greenwashing, the market is bifurcating. There are “paper credits,” and then there is True Carbon Removal.

Our credits represent a premium asset class. Why the disparity? Because we are doing the hard work of physically removing the carbon and locking it away.

Our price point reflects the reality of:

- Active Removal:

We are pulling legacy CO₂ out of the air, not just preventing new emissions. - Biochar Permanence:

By pyrolyzing our harvest into biochar and returning it to the soil, we convert labile carbon into a stable structure that persists for centuries. - Co-Benefits:

We are rebuilding topsoil, preventing erosion, and restoring the water cycle.

When you buy a Dynamic Carbon Credit, you aren’t just checking a compliance box. You are investing in a verified, physical reversal of atmospheric damage.

Defining "Additionality" in an Era of Skepticism

The concept of “additionality” is the bedrock of integrity in our industry. If a project would have happened anyway without the carbon revenue, it is not additional.

This is where many agricultural projects fail. If a farm is growing corn for ethanol and claims carbon credits for the stalks, the additionality is murky. The corn was going to be grown regardless.

Dynamic Carbon Credits offers clean additionality. Our crop is grown solely for the purpose of carbon sequestration and soil regeneration. It is an intentional climate intervention. Without the carbon market, this crop would not be in the ground. This clarity is essential for Fortune 500 companies who need their claims to withstand the scrutiny of shareholders, activists, and SEC regulations.

We further secure this chain of custody by leveraging blockchain technology, aligning with World Bank recommendations for digital transparency. From the field to the ledger, every ton is tracked, ensuring that when you retire a credit, it stays retired.

The Soil as Our Strategic Partner

NASA data continues to show the alarming rate of climate change, but often overlooked is the crisis of soil degradation. The UN FAO has warned that we have limited harvests left if we do not restore our topsoil.

Our Biochar Agricultural DAC-P process is a dual-threat solution. We use the atmosphere to fix the soil. By returning biochar to the earth, we are increasing water retention and reducing the need for synthetic fertilizers—which in turn reduces the Scope 3 emissions of the agricultural supply chain.

We are not just managers of carbon; we are stewards of the land. For our corporate partners, this offers a compelling narrative: Your investment is not just cooling the planet; it is revitalizing the ecosystems that sustain global commerce.

A Call to the Enterprise

Dynamic Carbon Credits is building an enterprise company for enterprise needs. We are not a small-scale experiment; we are a scalable solution ready for the Fortune 500.

The question for CSOs today is not “Should we offset?” It is “What is the quality of our portfolio?”

If your roadmap relies on low-quality avoidance credits or technologies that won’t be ready until 2035, you are carrying significant risk. It is time to diversify into high-speed, high-impact biological removal.

We are ready to deploy our 144-day cycle to meet your demand. Let’s stop waiting for the future of carbon removal and start growing it.

About the Author: Beau Parmenter is the CEO of Dynamic Carbon Credits, a leader in Biochar Agricultural Direct Air Capture. With deep expertise spanning agriculture, government, and business, Beau is dedicated to setting the benchmark for crop-based carbon neutral solutions that offer speed, scale, and verifiable permanence.